About one year ago, I decided to sign up for Robinhood. It’s basically a service backed by Google which is used to buy and sell stocks with $0 in commissions/fees. Robinhood also offers a premium paid service for some folks that buy/sell a lot more often than I do.

Buying individual stocks is generally considered a poor financial strategy due to volatility, so my real investments stay away from single stocks. Since there are no commissions or fees, I thought it would be fun to try and see if I how well I could do at playing the market based on my limited knowledge and some minimal research.

I put in a tiny initial investment, with a recurring weekly deposit of $15. This represents the maximum amount of money I’m willing to try on single stocks. My expectations are to break even overall and gain some learning when it comes to the overall market. If it all goes to 0, I’m comfortable with that. This area of investment represents a very small percentage overall for me.

The Robinhood app and service has been great. To date, I have made probably around 40 trades, both buying and selling. I have never been charged a commission or fee of any sort. In addition to regular buying/selling, the app will also allow limit purchases. I often use this method to purchase stock. With this method, you can specify the maximum amount you’re willing to pay per share.

Over the year, I have learned quite a bit about the stock market. My first trades involved solar energy companies. I felt like the technology was affordable and made sense for a lot of consumers. I even went pretty far into the process to acquire Solar City solar panels for my own house. After purchasing a couple stocks in that area(SCTY and SUNE), I eventually determined that Solar City wouldn’t work for me. In a short time, I was able to see a 25% return on the initial purchase, and knew it was time to sell.

My personal investment strategy is based off a simple algorithm. I generally invest in companies that make a product that I use and really like. If it’s not a product I use, it’s a product that I could see myself using. I have also put some investments in some medical companies with great dividends. When it comes time to sell, I only sell if I have made money. I will never sell a stock for a loss. This logic is almost certainly flawed, I know.

I have been a customer of Netflix since the beginning. Overall, it’s a great service. Coupled with a few other streaming services, it makes sense to cut the cord on cable. I made a large(for me) buy on Netflix at a price of $85.19 per share. The stock had just taken a dip due to some bad press. I was confident that it would recover. I’m still holding the stock for now at a current market price that you can check for yourself. Depending on when you read this, it has either been a good or terrible idea.

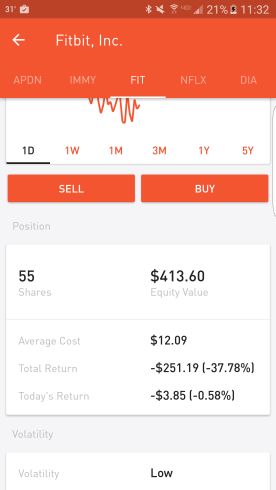

I bought Fitbit back at a time when the stock was around $16. At the time the expert consensus was that it would hit somewhere around $28. I have been a Fitbit user since 2013, and generally like their products. My first Fitbit product was the flex, I have also worn the Charge HR until it disintegrated last month. I recently purchased the Charge 2 which has worked pretty well over the last month or so. When the stock started to dip a bit, I decided that would be a good time to buy even more(at a perceived discount). At the time, I thought the stock was still stronger than suggested by the price, and if things went bad, I had effectively cut down my average cost price so I could get out at a lower price. At present time, I hold 55 shares of a stock all experts feel is a terrible buy.

I like the company and its products. Hoping to see a recovery after Christmas. Either way, I’m staying on the ship.

One drawback to buying and selling small amounts of stock is the tax implication. There are some rules about paying taxes on gains from stocks. Since I’m not really making a lot of money, the actual amount taxed is low, however tax preparation is a bit more costly. I generally use TurboTax, and I now have to buy the more premium package to do my yearly taxes. Robinhood does a good job of providing tax documents that ease with tax preparation. However, the added cost of TurboTax effectively negates pretty much all gains over the year in my situation.

Overall, Robinhood is a great app that allows both small and large investors trade for free. There are no catches other than some tax implications. It just seems that you might want to know something about the market before putting a large amount of money in. If you’re like me, and looking to play a few single stocks for the fun of it, Robinhood is the best way to go about it.

Leave a comment